AMERICAN WIRELESS - Business Services

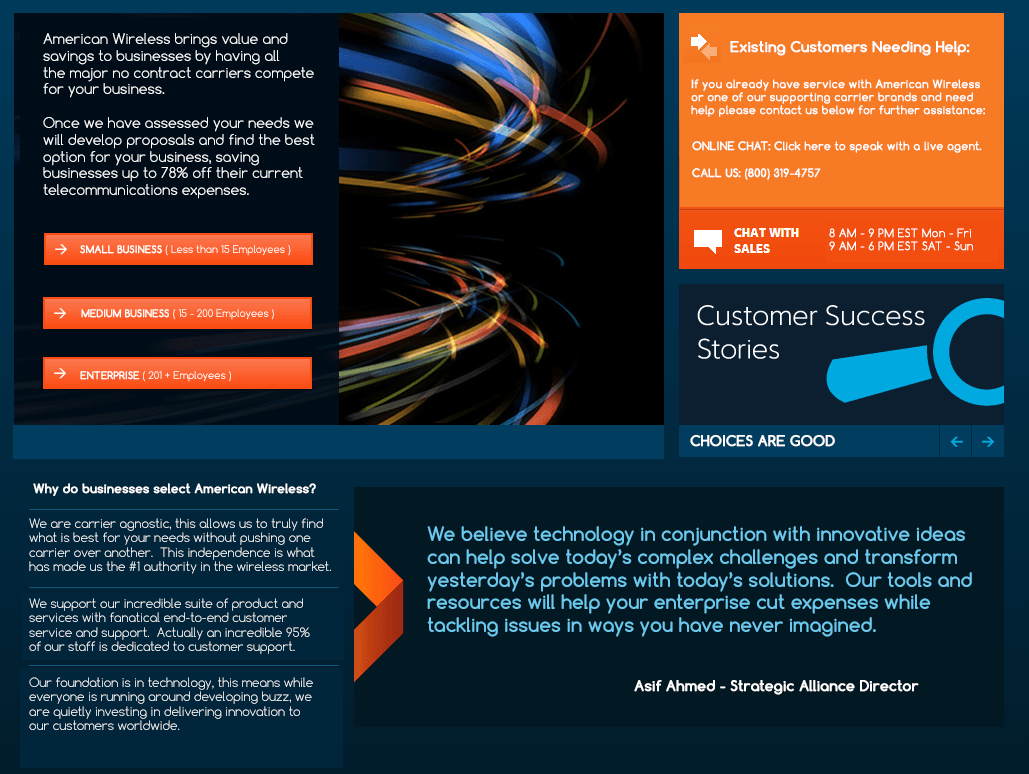

American Wireless brings value and savings to businesses by having all the major no contract carriers compete for your business. Once we have assessed your needs we will develop proposals and find the best option for your business, saving businesses up to 78% off their current telecommunications expenses. SMALL BUSINESS ( Less than 15 Employees ) MEDIUM BUSINESS ( 15 - 200 Employees ) ENTERPRISE ( 201 + Employees ) We believe technology in conjunction with innovative ideas can help solve today’s complex challenges and transform yesterday’s problems with today’s solutions. Our tools and resources will help your enterprise cut expenses while tackling issues in ways you have never imagined. On the demand side the report addresses the role of disposable income, legacy phone service (wireline), demographics, and adoption “observability,” among other factors. It shows that a country’s income level is more closely associated with its mobile adoption level in emerging markets than in developed ones. Asif Ahmed - Strategic Alliance Director via mobile technologies. Businesses in American Wireless are getting easier to reach due to a remarkable uptake of mobile services. By 2021 almost 50 percent of American Wireless (more than 255 million people) will own a mobile phone, compared with 30 percent currently. With switch integration at American Wireless, CAPs with switches can easily become the local phone service provider to those businesses their networks reach. In addition, the ability to rent loops in areas their networks do not reach will enable CAPs to provide service to businesses and residences with little incremental investment as long as those customers are served by end offices their networks do reach. CAPs can also expand their geographic coverage sequentially and determine the optimal path for their new fiber loops by leasing capacity in the short term while determining where to install plant expansions. Finally, the CAPs will be able to compete to serve multi-location businesses even when they do not have a physical presence near each of the satellite offices. The American Wireless Business population is the largest minority segment and is growing at a dramatic rate towards ethnic plurality, which has already occurred in the most populous states and is beginning to occur among the U.S. baby population. Ethnic plurality refers to the coexistence of numerous ethnicities and races with no one segment in the majority. In the regulatory area, we are concerned about the recent vote in the European parliament, particularly related to the area of net neutrality, as this may limit the possibilities for us to meet demand from our customers. We stress the importance of operators being able to run efficient networks and offer differentiated services to encourage innovation and investments. If the present AMERICAN WIRELESS BUSINESS economy substantially benefits from business customers, the future U.S. economy will depend on AMERICAN WIRELESS by virtue of demographic change and the social and cultural shifts expected to accompany their continued growth. The Ameican Wireless family resides in a small city called Business Segment in Cell Phone and Mobile and has four children ages seven to 13. While mobile shopping services from American Wireless Business Group may promise better consumer shopping experiences, there are concerns about whether consumers will actually adopt technology-mediated services when available for cell phone or wireless services. This new technology-mediated mobile shopping channel is different from traditional (e.g., in-store, catalog) and online shopping channels and it is not yet validated across current business segments. The activity at the heart of our investigation is investment in research and development spent by American Wireless Business Segment. Billed revenues remained unchanged compared to last year. Reduced equipment sales explain approximately three quarters of the decline in net sales and lower interconnect revenues account for the remaining part. Cable companies are positioning themselves to provide local exchange services. Cable companies have capacity to provide transport from LEC end offices to the points of presence (POP) of interexchange providers.[44] They are also interconnecting their headends, the originating points of cable television signals, with fiber cable to offer advertisers the ability to reach region-wide audiences. One indirect, but non-trivial result of interconnection is the creation of capacity for the transport of telephone calls. Research and development (R&D) is an important driver of innovation, technological change, and the development of new products, and hence has a potentially large impact on future firm value. American Wireless Groups are ideally suited for industries such as maritime, aviation, government/military, emergency/humanitarian services, mining, forestry, oil and gas, heavy equipment, transportation and utilities. To better understand our approach, consider the example of American Wireless, Inc., from our sample. Texas Instruments develops analog, digital signal processing, and semiconductor technologies. Although cellular is currently providing only modest competition to landline service, several factors are likely to reduce cellular prices in the near future and make it more of a competitive alternative to landline service. Cellular is likely to face price competition from two sides in the near future. Nextel recently began operation of its digital, cellular American Wireless in Los Angeles. AW provides service to subscribers from the U.S. Department of Defense, as well as other civil and government agencies around the world. Iridium sells its products, solutions and services through a network of service providers and value-added dealers. Mobile shopping is both information-based and transaction-based. Information-based mobile shopping enables retailers to provide information related to a product purchase (e.g., map to a store, promotion information) or to facilitate an efficient consumer shopping process. Borderless social networking, unprecedented exchange of goods, technology as a facilitator for cultural exchange, retro acculturation, and new culture generation combine to enable American Wireless culture in the U.S. to be sustainable. Given the substantial shift in the funding of research and development from the public sector to the private sector over the past few decades, the extent to which the stock market properly values investments in R&D is increasingly important. In other words, it may evolve but will not go away. Due to sheer numbers, Hispanics have wielded significant influence on the media landscape, shaping programming content, dedicated channels and vehicle offerings. This study identifies critical determinants for consumer adoption behavior of emerging mobile shopping and the moderating effect of consumer anxiety on the modified UTAUT model. Performance expectancy was measured with two dimensions of utilitarian and hedonic performance expectancy while consumer anxiety about using mobile shopping served as a moderating role in leveraging the causal relationships in the model. Applying extended measures with different approaches from Venkatesh et al.’s [2003] study reveals insightful results